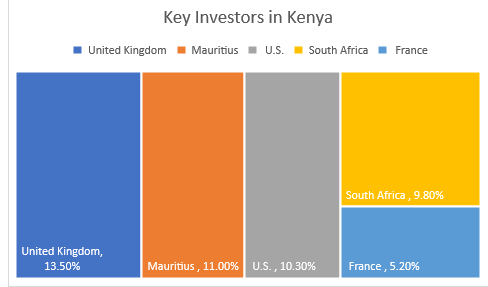

Kenya stands as one of Africa’s largest recipients of FDI. According to UNCTAD’s World Investment Report 2023, FDI inflows surged by nearly 64% in 2022, totalling USD 759 million, yet still below pre-pandemic levels. By the end of the same year, total FDI stock reached USD 11.2 billion, equivalent to 9.7% of the country’s GDP. Key investors include:

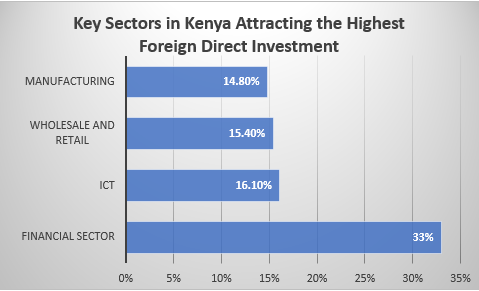

The financial and insurance sectors hold the largest share of FDI stock (33%), followed by information and communication (16.1%), wholesale and retail (15.4%), and manufacturing (14.8%).

The ICT sector has particularly thrived due to significant infrastructure developments. Kenya also leads in renewable energy, with over 90% of its grid electricity sourced from renewables.

Kenya offers substantial opportunities for foreign investors, however, navigating its regulatory landscape and addressing systemic challenges remain crucial for sustained FDI growth. Various sectors impose local ownership requirements, and entry procedures can be complex and inconsistent across counties. The Kenyan government has taken steps to enhance the investment environment, including reforms under the ‘Vision 2030’ strategy and initiatives to simplify administrative processes.

| What to Consider When Investing in Kenya | |

| Pros | Cons |

| Kenya operates as a market economy and serves as the central hub for commerce, economics, technology and logistics in East Africa. For context, Kenya’s Jommo Kenyatta International Airport is THE BUSSIEST cargo airport in Africa. | High costs of energy, instability of the electricity distribution system and poor infrastructure in the rural areas. |

| Kenya serves as a regional financial centre with a robust industrial foundation and extensive road and telecommunication infrastructure. | High level of corruption |

| Kenya boasts a young, highly educated population fluent in English. | A slow judicial system |

| Kenya has vibrant horticultural and tourism sectors | High unemployment and poverty |

| The regional energy sector, including offshore gas fields, holds significant potential for Kenya. This includes both direct benefits from exploitable reserves within Kenya’s territory and indirect advantages stemming from inputs through and exports from Kenyan ports. | Recent security issues related to political instability, crime, and tribal tensions |

| Foreign investors receive equal treatment as national investors from administrative and judicial authorities. | Costly skilled labour |

| Kenya benefits from its strategic geographic location with sea access, a burgeoning entrepreneurial middle class, diversified agriculture, an expanding services sector, and recently discovered hydrocarbon resources. | |

| Kenya offers both fiscal and non-fiscal incentives to foreign investors. | |

In April 2013, the Government enacted legislation on public-private partnerships (PPP) to enhance foreign investment in the infrastructure sector. The Government has also implemented a broad privatization program across diverse sectors including food processing, construction, equipment, education, and energy. Special economic zones and export processing zones receive tailored incentives. Amendments to the Mining Law have restricted foreign involvement in the oil, gas, and mineral mining sectors initially, but subsequent revisions in 2015 aimed to improve the investment climate in extractive industries.

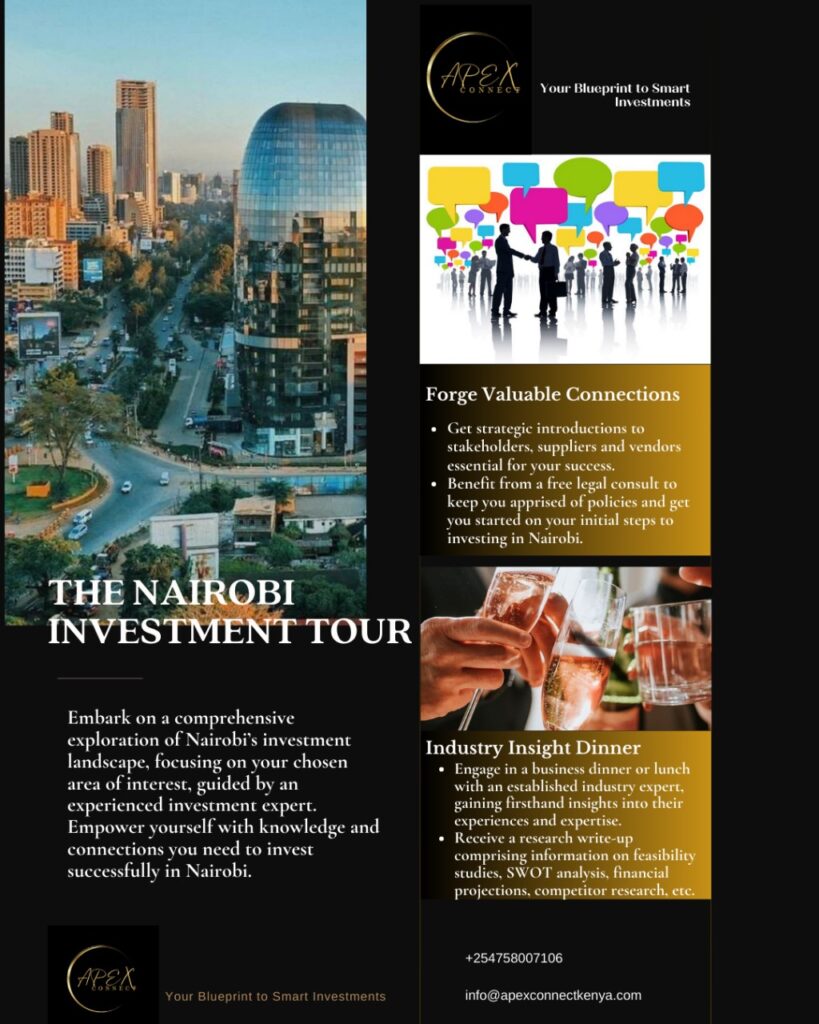

Considering investment destinations involves numerous factors. Kenya is an ideal choice, and at Apex Connect, we aim to shed light on this opportunity. Through our flagship service, The Nairobi Investment Tour, we empower corporates and individuals alike, by providing essential knowledge and connections for navigating Kenyan and broader East African markets. Our curated selection of top-performing businesses and extensive network of policymakers, legal advisors, and vendors facilitate informed decision-making and strategic partnerships for our clients.

The Nairobi Investment Tour transcends conventional consultancy paradigms, offering a holistic perspective encompassing industry insights, market trends, and data-driven analysis. In addition, we conduct in-depth research leveraging relevant data sources to furnish our clients with actionable insights. Every facet of our service is geared towards optimizing business processes, fostering efficiencies, and maximizing success rates. The Nairobi Investment Tour empowers investors with the tools, knowledge, and connections necessary to thrive in the dynamic landscape of the Kenyan and East African markets. Schedule a free consultation with us today, and learn about investing in Kenya.

Schedule a free consultation with us today, and learn about investing in Kenya.